When it comes to ATMs, most people think they're only good for one thing: withdrawing cash. However, these machines offer a range of convenient services that can make your banking experience easier and more efficient.

Let's explore 10 lesser-known tasks you can perform at an ATM , beyond the usual cash withdrawal.

1. Check Balance and View Mini Statement

Monitor your account activity and view the last 10 transactions to stay on top of your finances.

2. Transfer Money Card-to-Card

Transfer up to ₹40,000 daily between SBI debit cards without any fees, making it easy to send money to family or friends.

3. Credit Card Payment (VISA)

Pay your VISA credit card dues using your ATM card, eliminating the need for online payments or cheques.

4. Transfer Money Between Accounts

Link up to 16 accounts to your ATM card and transfer funds securely, streamlining your financial management.

5. Pay Life Insurance Premium

Pay premiums for LIC, HDFC Life, and SBI Life policies, ensuring you stay covered without hassle.

6. Request Cheque Book

Order a new cheque book and have it delivered to your registered address, saving you a trip to the bank.

7. Bill Payment

Pay utility bills for registered billers, making it easy to stay on top of your payments.

8. Register/De-register Mobile Banking

Activate or deactivate mobile banking services, giving you control over your banking experience.

9. Change ATM PIN

Update your PIN for enhanced security, protecting your account from potential cyber threats.

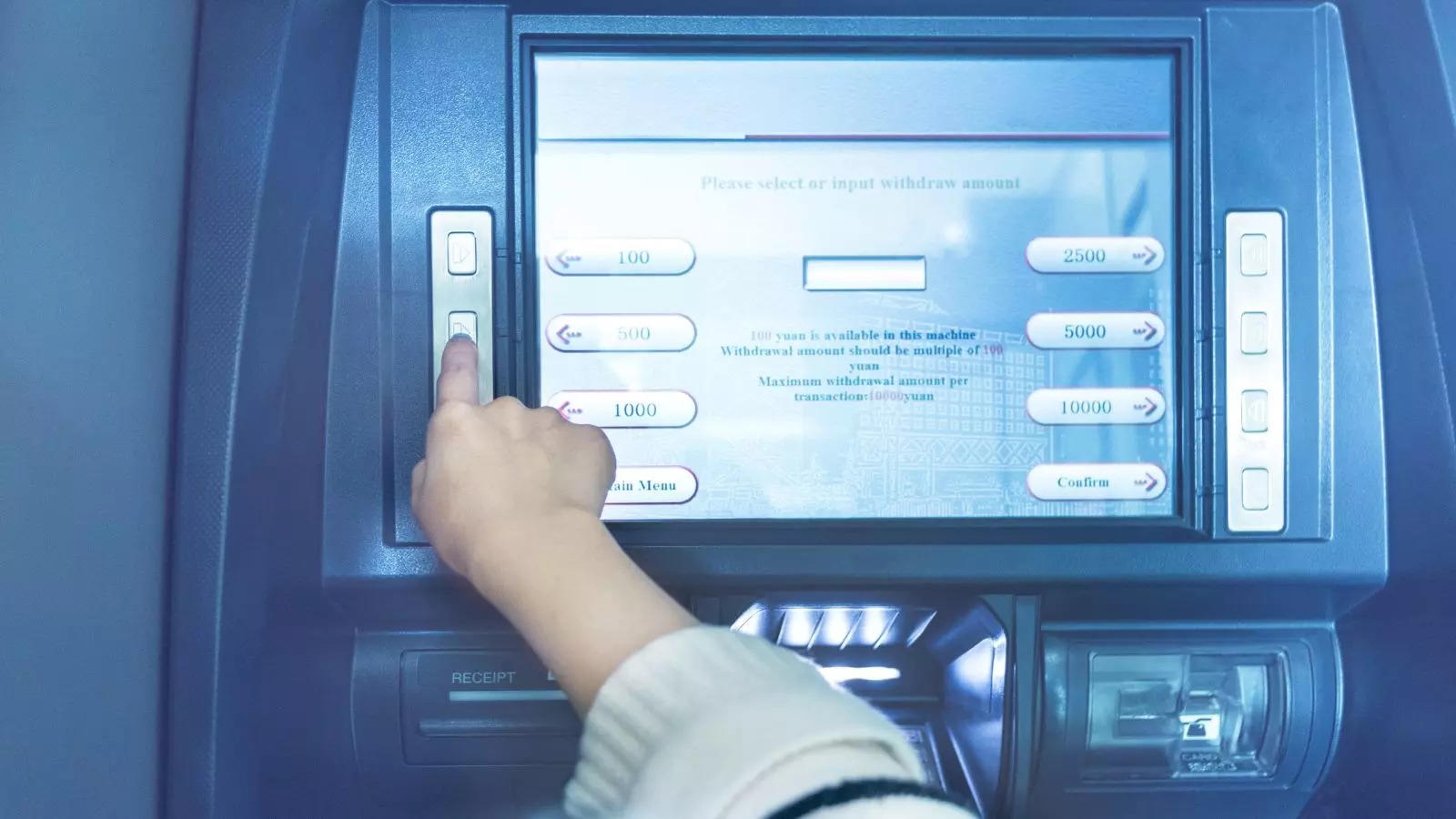

10. Money Withdrawal

Of course, the primary function of ATMs – accessible with your debit card and PIN.

By leveraging these convenient ATM services , you can streamline your banking experience and save time. Remember to always ensure your ATM card and PIN are secure, verify biller registration before making payments, and update your address for cheque book delivery.

Take advantage of these surprising ATM features today!

Let's explore 10 lesser-known tasks you can perform at an ATM , beyond the usual cash withdrawal.

1. Check Balance and View Mini Statement

Monitor your account activity and view the last 10 transactions to stay on top of your finances.

2. Transfer Money Card-to-Card

Transfer up to ₹40,000 daily between SBI debit cards without any fees, making it easy to send money to family or friends.

3. Credit Card Payment (VISA)

Pay your VISA credit card dues using your ATM card, eliminating the need for online payments or cheques.

4. Transfer Money Between Accounts

Link up to 16 accounts to your ATM card and transfer funds securely, streamlining your financial management.

5. Pay Life Insurance Premium

Pay premiums for LIC, HDFC Life, and SBI Life policies, ensuring you stay covered without hassle.

6. Request Cheque Book

Order a new cheque book and have it delivered to your registered address, saving you a trip to the bank.

7. Bill Payment

Pay utility bills for registered billers, making it easy to stay on top of your payments.

8. Register/De-register Mobile Banking

Activate or deactivate mobile banking services, giving you control over your banking experience.

9. Change ATM PIN

Update your PIN for enhanced security, protecting your account from potential cyber threats.

10. Money Withdrawal

Of course, the primary function of ATMs – accessible with your debit card and PIN.

By leveraging these convenient ATM services , you can streamline your banking experience and save time. Remember to always ensure your ATM card and PIN are secure, verify biller registration before making payments, and update your address for cheque book delivery.

Take advantage of these surprising ATM features today!

You may also like

Bhopal bastis to Karnataka villages, community libraries kickstart a reading revolution

IIT Dhanbad students celebrate Diwali in an unique way; send not just a firecracker but also a drum flying; check video here

Rohit Bal, rockstar of Indian fashion, passes away

K'taka BJP demands probe by ED, CBI into Waqf board irregularities

'Our twins have daddy and papa': A portrait of gay fatherhood