When Nazara bought 55% stake in Nodwin Gaming back in 2018, it was a risky bet that esports would one day rival cricket and Bollywood as a huge business opportunity in the entertainment industry.

But in 2018, India’s esports sector was barely on any radar, Smartphone penetration had created a generation of PUBG fans, but competitive gaming was seen more as a hobby or a break from work, rather than a profession or career.

Nodwin was only a small startup at the time, with a turnover of just INR 18 Cr, compared to Nazara’s revenue scale of close to INR 180 Cr. Plus, esports was still very much a niche category at the time of the acquisition.

Seven years later, Nodwin Gaming has gone beyond an esports company to targetting India’s wider youth culture and entertainment space with properties and IPs like Comic Con India, music festivals and other events that cut across gaming and entertainment segments.

From around INR 18 Cr in 2018, Nodwin reported INR 500 Cr in revenue in FY25. Nazara’s backing has been pivotal in that journey. But now Nodwin is looking beyond Nazara for the next phase in its journey.

Last week, Nazara disclosed that it has amended the investment agreement with Nodwin, reclassifying the company from a subsidiary to an associate. The move reduces Nazara’s board control but the gaming and entertainment giant remains the largest shareholder with a 46.87% stake.

For Nodwin’s cofounder and managing director Akshat Rathee, this transition is not about separating from Nazara, but about enabling flexibility and bringing in more investors.

“When Nazara invested in us we had just $2 Mn in turnover,” Rathee told Inc42. “We’re now a fairly large company with ambitions of touching $100 Mn in the next two years and $1 Bn in revenue in the next five years.”

Rathee added that the journey will require bigger capital pools than Nazara’s typical cheque size in the $20 Mn–$50 Mn range. Which is why Nodwin is eyeing a $100–200 Mn raise in the next few years to fund international expansion and acquisitions, and push the revenue needle.

The cofounder explained that by relinquishing board control, Nazara has cleared the path for Nodwin to bring in new investors who may otherwise hesitate to back a tightly held subsidiary.

The reclassification also relieves Nodwin from the burdens of being treated as a “deemed listed” company, where it had to comply with the strict disclosure and compliance rules of a publicly traded entity without the associated benefits.

On whether Nazara’s move reflects reduced confidence, Rathee is unequivocal. “Nazara has not sold a single share. They would rather own 48% of a $1 Bn company than 52% of a $200 Mn company.”

New Partners For Global AmbitionsTo get to its revenue targets, Nodwin’s focus is squarely on global markets and holistic strategy. The company wants to scale its IPs across continents while also acquiring local organisers, content companies, and adjacent businesses outside its key current markets India, the Middle East, Southeast Asia, and parts of Central Asia,

Plus, like Nazara, Nodwin will be taking the inorganic route to grow. The M&A strategy is three-pronged — acqui-hires, geographical expansion and new verticals. “Through acqui-hires we bring in phenomenal teams doing great work in smaller pockets. Second, geographical expansions in markets like Southeast Asia, Latin America, Africa, Central Asia. And third, what I call blind spot acquisitions that means areas we don’t currently cover, like ticketing, where it’s faster to acquire than to build,” Rathee elaborated

Naturally, this calls for significant capital firepower, which is why Nodwin’s next raise will be crucial. Rathee is eyeing a revenue bank of $100–$200 Mn over the next few years, which would allow it to pursue multiple acquisitions simultaneously while also doubling down on existing IPs.

One such lucrative acquisition was Comic Con India. This much-hyped event is already expanding from eight cities in 2024 to nearly a dozen in 2025. Two new festivals are also in the pipeline, alongside international projects in the Middle East, Southeast Asia, and CIS countries, Rathee added.

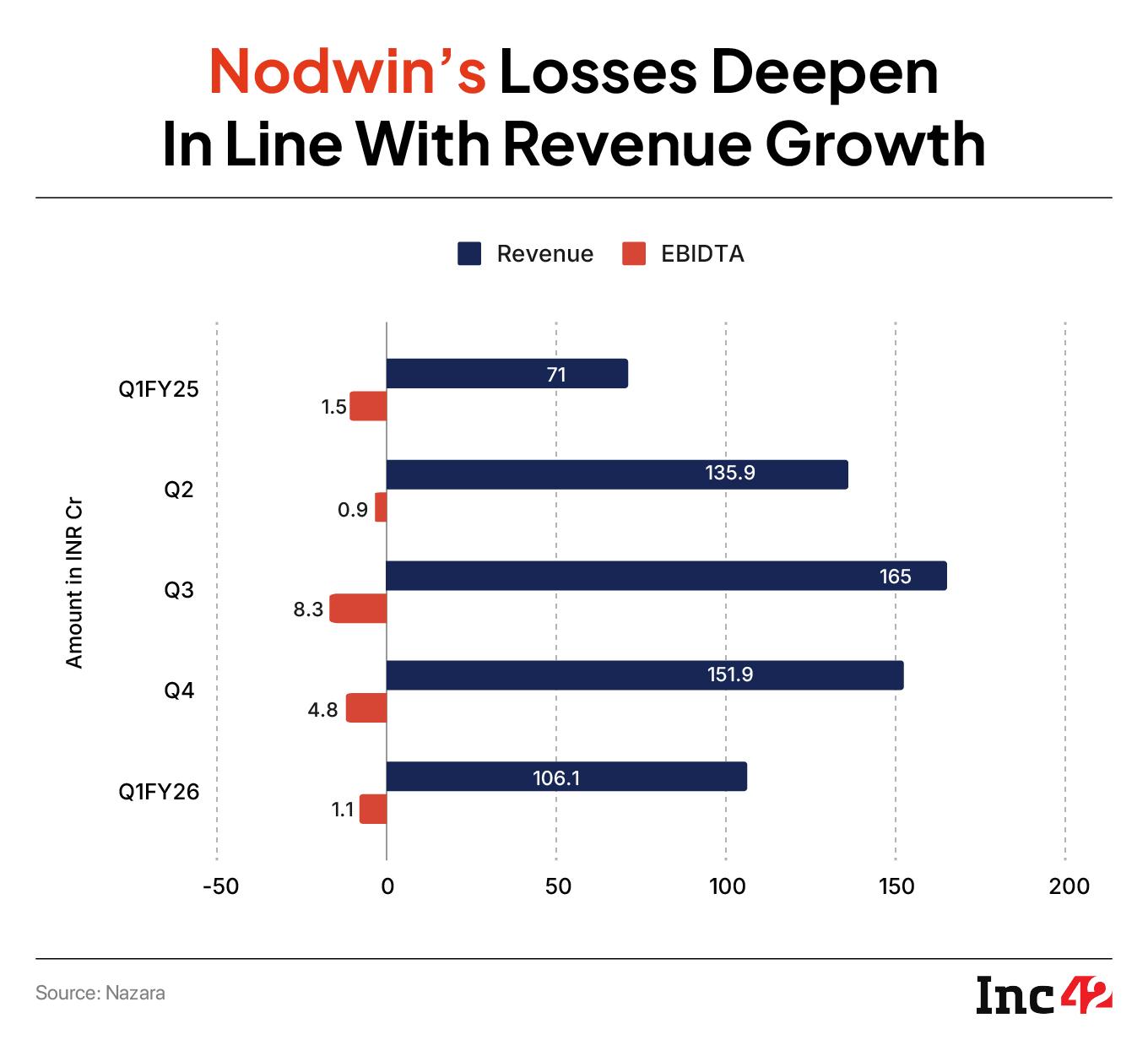

In Q1 FY26, Nodwin’s revenue grew by 49% YoY to INR 106.1 Cr driven by growth in the media rights business, but the company’s losses grew by 10X on a sequential basis from INR 1.5 Cr in Q4 FY25 to INR 11 Cr in Q1 FY26.

One key media rights deal was Nodwin bagging the South Asia rights for the Esports World Cup (EWC), but now the company is looking at other IPs around the world.

At the core of Nodwin’s revenue focus is live IPs or live content formats that can generate multiple monetisation streams. Whether it’s a music festival, esports tournament, or live IPs, these create revenue from sponsorships, ticketing, merchandising, F&B, media rights, and even data partnerships.

“The IP business is a rights business. The other side of our revenue is the agency business, which is work-for-hire. Brands like Diageo and Red Bull hire us to execute their IPs. Both sides contribute roughly 50% each to our revenue,” the MD claimed.

Going forward, Rathee sees three big faucets for monetisation. First, the global expansion of live IPs across new markets. Second, scaling in-person live experiences, from tournaments to meet-and-greets, which he believes will be the largest growth driver worldwide. And third, rationalising synergies across Nodwin’s international network—where intra-group revenues already account for 10–15% of the topline, a figure he wants to grow to 20–25%.

Rathee believes Nodwin’s scale and first-mover advantage give it a defensible moat. And it needs one because the esports landscape in India and Southeast Asia is becoming increasingly competitive, with new organisers entering the fray.

Nodwin may not have heavy direct competition in India, but when it goes abroad, it will need to carve out a strong brand to attract the best sponsors, commercial partners and consumers. “Gaming and esports are winner-takes-all markets. Our ability to consistently grow 40–100% year after year, and even last year at 40–60%, is what sets us apart. That, combined with our ability to provide liquidity to investors, becomes our moat,” the cofounder claimed

He also pointed to a softer factor: Nodwin’s culture of mentoring smaller gaming and esports startups that are actually competition. “They are the future. I don’t want to cling on forever. So if they build great companies, we can give them access to investors and bigger opportunities.”

Nodwin’s bullishness comes despite headwinds in the esports market. Even industry leaders like ESL have resorted to layoffs as profitability takes precedence over hype. Rathee believes that India is still in its growth phase, driven by mobile-first gaming and a young demographic.

But there’s a structural challenge. “Esports in India has a cricket problem. Cricket is huge, but no other sport comes close. Similarly, BGMI dominates Indian esports, but for real depth, we need multiple games just like the US, China, or Europe to thrive. These markets have breadth across sports and games.”

Cricket is not an easy challenge to solve. Pretty much every gaming studio has tried to target this game and esports offers a natural extension to formats like fantasy gaming or multi-player local competitions.

The real test for Nodwin will be in diversifying IPs and working closely with publishers to build competitive ecosystems around multiple titles and breaking through the cricket bubble. At the same time, esports companies run the risk of overleveraging their content libraries like the media streaming and OTT market.

Rathee claimed that the OTT space is consolidating and not expanding. “It’s not an opportunity segment anymore. Globally, media companies are shifting focus back to profitability and sustainability.”

For Nodwin, this translates into a preference for direct-to-consumer models like ticketing and subscriptions, with advertising serving as an add-on rather than a core revenue stream. The MD also pointed to advertisers moving away from CPM-based models to more integrated partnerships.

In other words, Nodwin sees itself less as a media platform competing with OTTs and more as a rights-holder whose content gets distributed across platforms—be it YouTube, Hotstar, or Instagram.

“In-game advertising, like the Steam activation we did inside BGMI, will become more salient than traditional TV-style ad slots,” he added. “Even Jio had to reposition IPL metrics from total views to peak concurrency, because that’s what advertisers actually care about.”

IP-First Or Platform?Despite persistent questions from investors, Nodwin has no immediate plans to pivot into platform-driven revenues. That IP-first philosophy has worked well so far. It has enabled Nodwin to build Comic Con into India’s largest pop culture event, to expand esports tournaments into multiple geographies, and to become a partner of choice for global brands experimenting with youth engagement.

“If you want to be a platform, you need to understand acquisition, CAC, LTV, retention—all of that. I don’t know how to do that. Until one of our founders truly understands it, we will remain IP-first,” Rathee admitted.

As Nazara steps away, Nodwin is now poised for an ambitious phase. The company has the room to onboard large investors, the clarity of being an IP-first player, and a roadmap that spans continents, but there’s no real precedent for an Indian company becoming a large and significant esports player globally.

Can Nodwin replicate its India playbook in more mature markets where competitors have the luxury of stronger brands and market connections? Scaling live IPs across cultural contexts is no easy task, and competition from both local organisers and global majors will be intense. At the same time, the esports industry remains in flux, and at some point in time profitability pressure will trickle down to Nodwin as well.

[Edited by Nikhil Subramaniam]

The post No Longer Under Nazara’s Wing, Can Nodwin Gaming Level Up? appeared first on Inc42 Media.

You may also like

TVK's 2nd state conference in TN's Madurai today, Vijay set to give political message

Four children drown in water-filled pit in Maharashtra

'Handwriting a lost art'? Zoho's Rs 50,000 cr man's fear sparks fiery internet debate

Hurricane Erin nears US East coast: North Carolina's outer banks hit; NHC warns of 'life-threatening surf and currents'

The pretty Scottish village where Donald Trump's mother was born and locals 'despise' him