India's private sector companies, with stronger financials and adaptability to emerging challenges, are well poised to support the nation's growth aspirations in a sustained manner, a Reserve Bank of India study said.

Their improved debt servicing capacity over the past five years has also boosted the overall financial stability metric, the paper said.

"With a robust financial foundation and adaptive strategies, the sector remains well-placed to capitalise on future opportunities and contribute to sustained economic expansion." the central bank researchers from the Department of Statistics and Information Management said. The study underscores the corporate sector's ability to navigate crises and emerge stronger, positioning itself as one of the important drivers of India's economic growth.

The study underscores the corporate sector's ability to navigate crises and emerge stronger, positioning itself as one of the important drivers of India's economic growth.

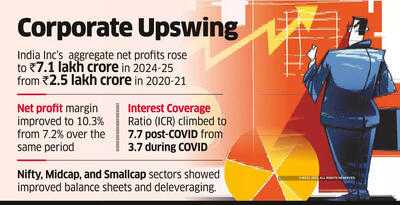

Corporates continued to deleverage their balance sheets supported by capitalisation of higher profit with debt-to-equity ratios improving across firm sizes. This helped corporations undertake fresh investment activities.

"From a macroeconomic perspective, the sector's improved balance sheet position is an important contributor to India's medium-term growth momentum, while also reducing systemic vulnerabilities in the financial system," the study said.

The report, prepared by Snigdha Yogindran, Sukti Khandekar, Rajesh Kavediya, and Kamal Gupta, observed that India's private corporate sector rebounded strongly after the pandemic, showing resilience and adaptability. Sales growth peaked at 32.5% in 2021-22 before normalising at 7.2% in 2024-25, reflecting a transition from a rapid recovery phase to stable growth.

The views expressed in the article are personal views of the authors, the central bank said.

Post-pandemic, companies improved their ability to service debt, with the interest coverage ratio rising significantly. The interest coverage ratio (ICR), which measures a company's ability to pay interest on its debt, shows a notable improvement at an aggregate level during the post-COVID period compared to pre-COVID and during COVID times, the report said.

Small- and medium-sized firms have done better on this count.

The corporate sector aggregate net profits rose significantly to Rs 7.1 lakh crore in 2024-25 from Rs 2.5 lakh crore in 2020-21. Consequently, the net profit margin improved to 10.3% during 2024-25 from 7.2% in 2020-21. This helped the ICR to rise to an average of 7.7 post-COVID, from 3.7 during COVID, signifying a notable enhancement in financial health and a stronger capacity to service debt.

The evidence indicates that while large firms led the rebound in profitability, medium and small firms recorded notable improvement in debt serviceability and operational efficiency, pointing to a more balanced corporate landscape.

Looking ahead, sustaining corporate growth will largely depend on a combination of factors such as macroeconomic conditions, domestic demand, supportive policy measures, and global market dynamics, the study said. Additionally, strengthening supply chains, improving cost efficiencies, and fostering technological innovations will play key roles in maintaining competitiveness and shaping overall corporate performance.

Their improved debt servicing capacity over the past five years has also boosted the overall financial stability metric, the paper said.

"With a robust financial foundation and adaptive strategies, the sector remains well-placed to capitalise on future opportunities and contribute to sustained economic expansion." the central bank researchers from the Department of Statistics and Information Management said.

Corporates continued to deleverage their balance sheets supported by capitalisation of higher profit with debt-to-equity ratios improving across firm sizes. This helped corporations undertake fresh investment activities.

"From a macroeconomic perspective, the sector's improved balance sheet position is an important contributor to India's medium-term growth momentum, while also reducing systemic vulnerabilities in the financial system," the study said.

The report, prepared by Snigdha Yogindran, Sukti Khandekar, Rajesh Kavediya, and Kamal Gupta, observed that India's private corporate sector rebounded strongly after the pandemic, showing resilience and adaptability. Sales growth peaked at 32.5% in 2021-22 before normalising at 7.2% in 2024-25, reflecting a transition from a rapid recovery phase to stable growth.

The views expressed in the article are personal views of the authors, the central bank said.

Post-pandemic, companies improved their ability to service debt, with the interest coverage ratio rising significantly. The interest coverage ratio (ICR), which measures a company's ability to pay interest on its debt, shows a notable improvement at an aggregate level during the post-COVID period compared to pre-COVID and during COVID times, the report said.

Small- and medium-sized firms have done better on this count.

The corporate sector aggregate net profits rose significantly to Rs 7.1 lakh crore in 2024-25 from Rs 2.5 lakh crore in 2020-21. Consequently, the net profit margin improved to 10.3% during 2024-25 from 7.2% in 2020-21. This helped the ICR to rise to an average of 7.7 post-COVID, from 3.7 during COVID, signifying a notable enhancement in financial health and a stronger capacity to service debt.

The evidence indicates that while large firms led the rebound in profitability, medium and small firms recorded notable improvement in debt serviceability and operational efficiency, pointing to a more balanced corporate landscape.

Looking ahead, sustaining corporate growth will largely depend on a combination of factors such as macroeconomic conditions, domestic demand, supportive policy measures, and global market dynamics, the study said. Additionally, strengthening supply chains, improving cost efficiencies, and fostering technological innovations will play key roles in maintaining competitiveness and shaping overall corporate performance.

You may also like

US Marshal and immigrant shot during ICE operation in South LA; DHS issues statement condemning 'sanctuary politicians'

BBC Ambulance viewers left sobbing just minutes into new episode

Tamil Nadu: All schools to remain closed due to heavy rain in Chennai

Nat Sciver-Brunt Approaches 1,000 Runs Milestone Ahead of England vs Australia Clash

Police van in flames as migrant hotel protest explodes after alleged rape of 10-year-old